Insights

KiwiSaver: improving workplace wellness and reducing climate panic

Worried about climate change? Your KiwiSaver could be the fastest way to help address that sinking feeling.

"“We believe no one should have to choose between an ethical investment and a profitable one." - John Berry

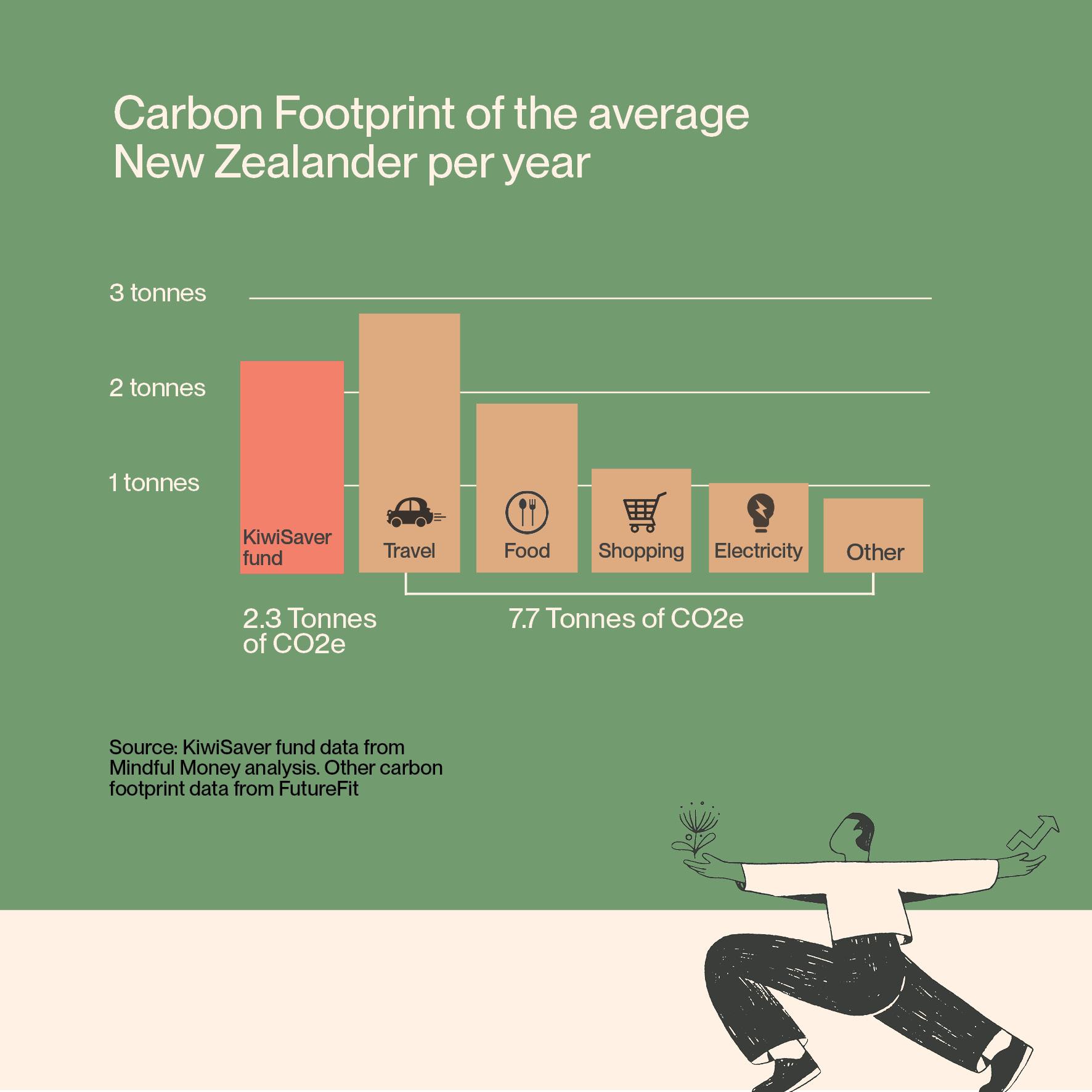

Did you know that 23% of a Kiwi's carbon footprint comes from their KiwiSaver investments? Those investments are behind a big chunk of our emissions – second only to transport. For a nation passionate about reducing its negative impact on the environment, that's surprising and shocking news. By taking a few simple steps employees and business owners can do something about it.

How did this happen?

For many people their KiwiSaver is a mystery – they know they have one, but don’t know where it is, how much is in there, if it’s helping them achieve their retirement goals, or exactly what it’s invested in. KiwiSaver is a bit like car insurance – you can get it from a variety of providers, the cost, benefits and risks are different depending on who you choose.

Some of the largest KiwiSaver providers invest in index funds based, for example, on the NZX50 Index or S&P500. Index funds ‘buy the market’ and give a broad array of shares in one bundle that is usually made up of the largest companies in Aotearoa New Zealand. They are ‘passive’ investments, meaning there isn’t a fund manager actively selecting what shares to buy and analysing when to sell. Generally, this results in the fees being lower. But it also means that people who use that provider have little control over the kinds of companies their KiwiSaver funds are invested in.

Concerning companies

In 2016 the NZ Herald released an article "The dirty secrets of KiwiSaver" exposing New Zealand companies investing in cluster bombs, nuclear weapons and animal testing. Since then, the market has been cleaning up its act, but there is still a long way to go. The largest KiwiSaver providers still invest in ’companies of concern’ that are involved in activities such as mining, fossil fuel extraction and the abuse of human rights. Some funds still include companies like BHP Group Ltd, Cheniere Energy and Shell PLC that are expanding fossil fuel production and making no headway towards meeting UN climate objectives to reduce temperature rise.

Many Kiwis are horrified to learn what their money has been invested in

“I was exposed to ethical investing through Mindful Money, and was frankly disturbed to discover what sort of things my bank was investing in. It felt terrible to know I was inadvertently putting money towards supporting industries like weapons; that I had a direct connection to enabling war and suffering. It also made me trust my bank a lot less… Faced with global existential challenges such as climate change, poverty, and threats of war, it can be hard to find companies you trust and choices to make where you know you're doing the right thing.” Marlies Zyp van der Laan, KiwiSaver Investor.

How to fix it, quickly

To reduce the carbon emissions coming from your KiwiSaver investments, one of the most impactful and easiest things you can do is switch your KiwiSaver provider to one with low emitting investments. For comparisons the Mindful Money fund checker is a great place to start. What’s that got to do with the workplace? Potentially, everything.

KiwiSaver at work

Every New Zealand resident can have a KiwiSaver to help them save for their retirement. Kiwis currently have almost $92 billion invested in KiwiSaver. Also, every New Zealand company can select their preferred KiwiSaver provider. This means new staff joining without a KiwiSaver do not need to be allocated to a random default KiwiSaver scheme, which is more likely to be invested in the ‘index funds’ mentioned earlier. Businesses can choose a preferred KiwiSaver provider that reflects their values – especially important if you’re on a sustainability journey.

Picking a preferred provider matters. It means all staff will have optional access to financial education from that provider. This can help improve their financial knowledge which in turn may help reduce financial-related stress. It feels like a responsible thing for employers to do.

Feel good while you save for your future

Pathfinder is a KiwiSaver provider that’s helping address the climate crisis rather than making it worse. We recently won Mindful Money’s Best Ethical KiwiSaver Provider Award for the third consecutive year (2021, 2022 and 2023). We were the first fund manager in Aotearoa New Zealand to achieve B Corp™ certification and focus on reducing the carbon footprint of its KiwiSaver investments.

Companies often choose Pathfinder as their preferred provider as their values align with our vision "for investing to fund a lasting transformation to a better world". And they want to be able to showcase to their staff, shareholders, board and customers that they are proactively managing their impact directly or indirectly. Pathfinder is different from index funds. We select investments to match our mission of generating individual wealth and collective wellbeing. You can invest ethically and still focus on generating great returns.

“We believe no one should have to choose between an ethical investment and a profitable one.”

says CEO Pathfinder John Berry.

We value financial education and help employees make informed decisions for their future and the planet. We run regular workshops and are very happy to help companies and their employees with their KiwiSaver questions.

Past performance is not a reliable indicator of future performance. Pathfinder Asset Management Limited is the issuer of the Pathfinder KiwiSaver Plan. A Product Disclosure Statement for the offer is available at pathfinder.kiwi.