Insights

Redefining Investment Success: Beyond Financial Gains

Are traditional metrics for financial success still serving us, or is it time to think differently?

What does success mean to your client?

Ask an 80-year-old what they value with their investments, and they are likely to say returns, ask a 40-year-old and you may get a surprisingly different answer – you’ll probably find they care about quite different things. Traditional metrics of investment success have been dominated by returns, risk management, and portfolio growth. But our recent market research suggests that things are changing, and we could see far more people measuring success differently, especially younger generations.

Where good, returns: More than just a catch phrase

Key insights from our recent market research, conducted by Clarity Insight, suggests a clear sense that the trajectory of societal trends indicates a promising future for ethical brands, including investment funds. This is reinforced by younger people being more likely to be aligned with the principles of ethical investing, suggesting a generational shift in attitudes that will organically grow demand for ethical funds in the future.

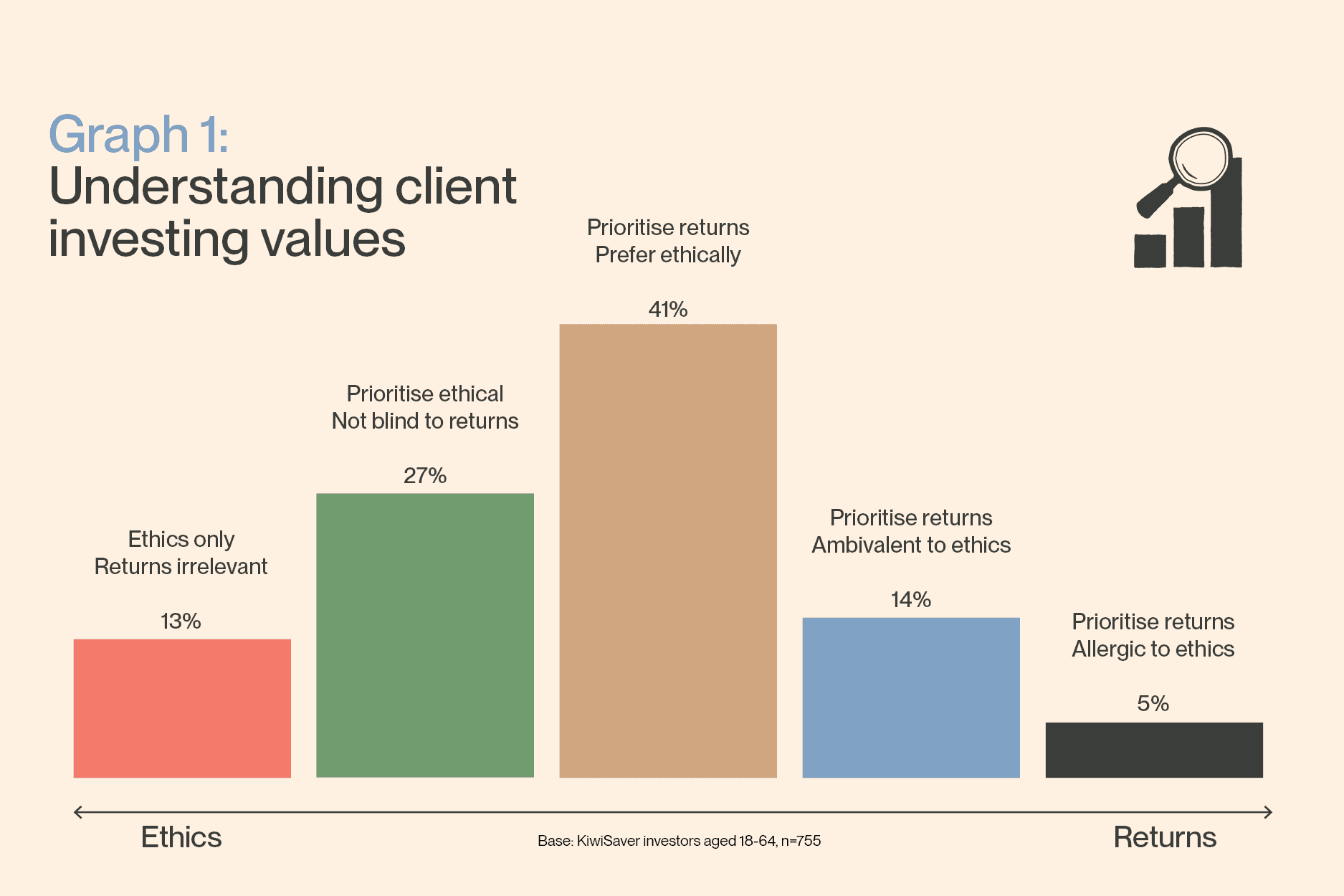

Our research showed there is a whole segment of investors that know that doing ‘good’ can be rewarding – for society and themselves financially. And it’s interesting to note, that this segment is only after returns ‘as good as’ their existing provider, if they understand they are making a difference. We also found a clear skew towards ethical attitudes to investing compared to those that are simply after maximising returns (see Graph 1). This made us think, if we had done this research 40-years ago, what would Graph 1 have looked like?

Win-win outcomes

These graphs, our research and research by RIAA and Mindful money (see key findings on Graph 3) suggest that this is more than just a trend; it's an evolutionary shift. We believe that as stewards of capital, we have a responsibility to direct funds toward ventures that align with our principals, (think holistically, lead bravely, be change makers and be good ancestors) and consumers are waking up to the idea that they can have two-fold success – wealth and well-being.

However, we also found, that while some investors can recite some of the core fundamentals of ethical investing (aligning with values or beliefs, avoiding companies with negative social or environmental impacts, being socially responsible), actual practical knowledge of what investing ethically means, is very limited. This is where you come in.

Helping investors find the balance between ethical and returns

Helping investors understand the difference between terms such as ethical, socially responsible, green or impact investing and how these different investment approaches work will go a long way towards helping potential investors understand the difference, and in turn the impact they can make. Here’s a few ideas on how to navigate this balance effectively:

Understanding what matters: Encourage investors to identify what matters most to them. For instance, is it environmental sustainability, social equity, animals or community impact? This introspection can guide investment choices.

Explore emotional intelligence: Foster conversations that explore the emotional aspects of investing. How does supporting a local business or investing in clean energy make them feel? This emotional engagement can drive more fulfilling investment choices and increase client engagement.

Education on ‘ethical’: Provide information on ethical investing strategies—such as impact investing, socially responsible investing, and ESG criteria. Where are the overlaps, where is the greenwashing?

For example, tobacco is an area many will want to exclude due to the social harm it causes and yet British American Tobacco has a high ESG ranking across a range of rating agencies. Explaining ESG, and its limitations, to investors is a critical step to ensure they don't invest in activities they disagree with.

Share the evidence: Research showed us that those particularly open to an ethical provider want proof of its impact. Real world examples of good returns from a company that meets an explained ethical standard, empowers people, by joining word with deed.

We discovered, from our research, which segment of the market would be most interested in Pathfinder products. We want to share with you some of their traits so you can identify which of your clients might be in this demographic.

Some key findings included that they regularly use a 'Keep Cup', are into their composting, watch TV and movies and enjoy music, travel and reading - no surprises there. But interestingly, they are approximately 30% more likely to regularly donate to charity, boycott brands at odds with their personal values, and volunteer to support a worthy cause. These are all areas you could discuss in your one-on-ones to learn if you’re working with a principled investor.

We discovered, from our research, which segment of the market would be most interested in Pathfinder products. We want to share with you some of their traits so you can identify which of your clients might be in this demographic.

Some key findings included that they regularly use a keep cup, are into their composting, watch TV and movies and enjoy music, travel and reading - no surprises there. But interestingly, they are approximately 30% more likely to regularly donate to charity, boycott brands at odds with their personal values, and volunteer to support a worthy cause. These are all areas you could discuss in your one-on-ones to learn if you’re working with a principled investor.

Collaboration for a better future

At Pathfinder, we are committed to leading this shift towards investing ethically and we’d like to collaborate with you to ensure we are hitting the mark. We want our members to feel empowered by the choices they have made, so we will continue to share stories about the impact they are making through our socials and newsletters - make sure your clients are signed up if they are interested (there is a newsletter box on our website). And, as always, your feedback is welcome – please let us know if you think there is anything we can do to improve.

Between us, we can motivate and champion a new era of investment that values both profit and purpose, creating a legacy that we can all be proud of – one that is not only defined by what we earn, but by the positive change we create.