Insights

The ‘value’ placed on conflict - finance & the arms industry.

As grim headlines on conflict flood our news channels, it raises the question: is it ethical to profit from conflict?

"We invest looking through an opportunity rather than a constraint lens" Mike Kenealy, Portfolio Manager

It feels like our world is less stable and more geopolitically complex as every year passes. Multiple conflicts continue in central and northern Africa, war continues in Ukraine, conflict is escalating in the Gaza strip and there is heightened tension in South China Sea. In fact, according to the Council on Foreign Relations there are currently 27 conflicts globally.

As news channels flood us with images of human suffering it highlights a hot topic for responsible and ethical fund managers (and advisers) around the moral complexities of financing the arms industry.

At Pathfinder, our Ethical Investment Policy helps guide our investing, with an overarching goal of generating individual wealth and collective wellbeing. When it comes to weapons, we have a zero tolerance for controversial weapons (examples include chemical, biological, nuclear and cluster munitions), and a very low tolerance for companies that derive revenues from components of weapon systems, support systems, and services directly related to military weaponry.

But you’d be surprised how many fund managers globally don’t see things quite the same way and that’s because when it comes to making money, conflict is a trillion-dollar industry.

World military expenditure was estimated to be well over $2 trillion in 2022. The five largest spenders are the United States, China, India, the United Kingdom and Russia, together accounting for 62 per cent of expenditure, according to new data on global military spending published today by the Stockholm International Peace Research Institute (SIPRI 25 April 2022).

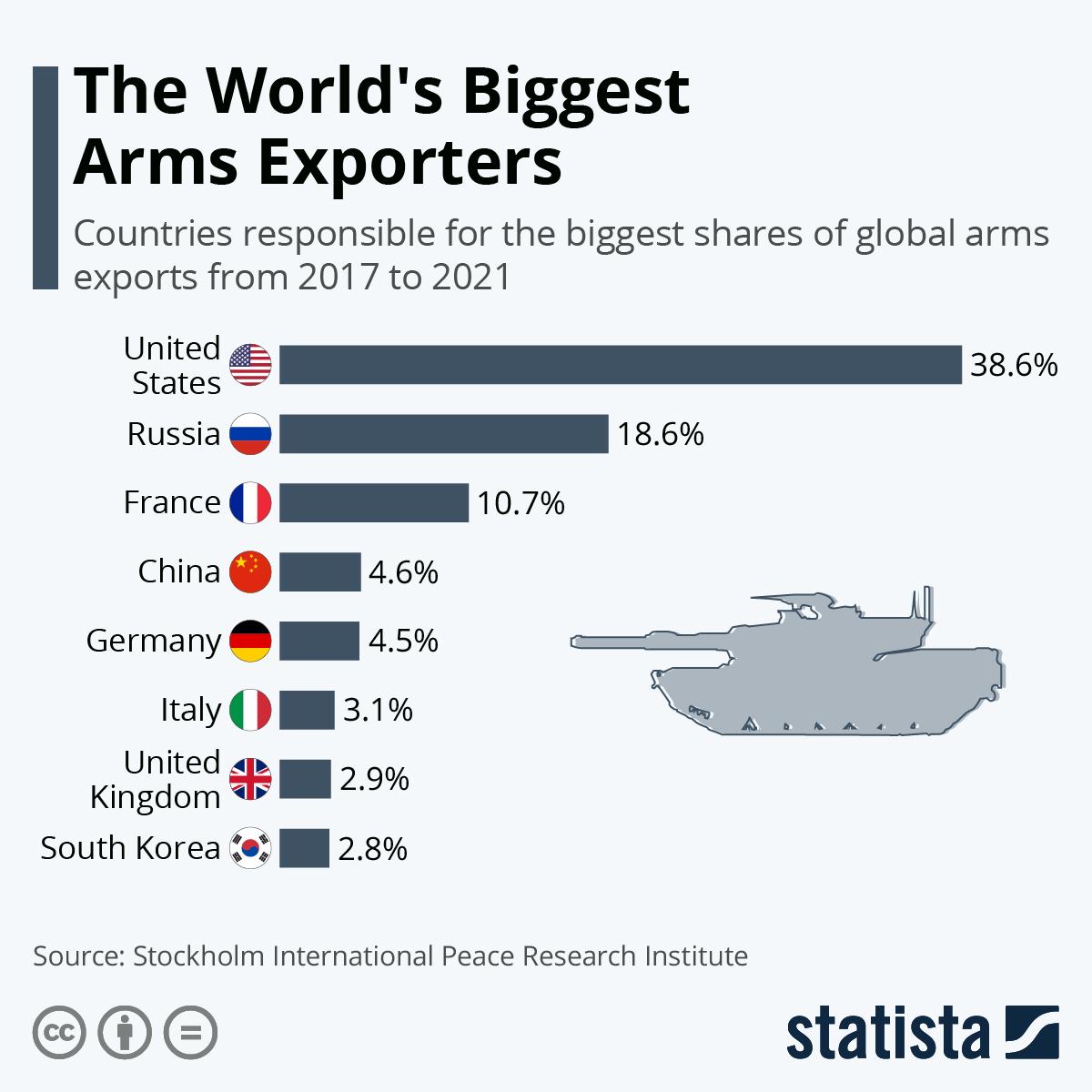

The United States is the largest supplier of military equipment, supplying 38.6% of international arms sales between 2017 and 2021 to more than 100 countries. The top five companies from the US alone report revenue over $200 billion annually. And, according to an interview by Al Jazeera in April 2022, in one year the average American taxpayer pays about $2,000 in taxes towards military spending and over $800 to military contractors. By comparison they only pay $27 towards disease control and prevention and $5 towards renewable energy.

These statistics highlight that conflict is incredibly profitable for some yet little attention is given to the companies producing the weaponry and the impact this is having.

Daniel Ellsberg was a military analyst who leaked 7,000 pages of top-secret Pentagon documents to the press in 1971. He uncovered years of misinformation about the Vietnam war. In this interview with Al Jazeera he says “It’s a bit like talking about climate change without mentioning Shell, Exxon Mobil or BP. We direct large sums of money towards these huge companies that make military weaponry, but no one ever mentions their names.” The biggest ones in the US include Raytheon, Boeing, Northrop Grumman and General Dynamics Corporation.

But it’s not just an American issue, according to Mindful Money, in June 2023 there was still $190 million of KiwiSaver funds invested in in companies involved in the manufacture of weapons like firearms, missiles and ammunition such as BAE and Lockheed Martin. That is despite three quarters of Kiwis saying they want their KiwiSaver and other investment funds to be managed ethically (Mindful Money).

At a Responsible Investment conference in 2022, the topic of investing in weapons came up in the context of the war in the Ukraine. Members of a panel talking about ethical investing were asked how they thought it was justified to not invest in weapons when Ukraine needed them to protect itself against Russia.

At first this can seem like a compelling position, until you hear the conflicting arguments. Firstly, as an investor, you have no say over who the weapons manufacturer supplies. They could sell high-tech weaponry to either, or both sides of a conflict. Which brings us to the second key point, and a major reason they make money from the continuation of conflict - if you would like to see the world solve its problems through methods other than violence and death, investing in weapons isn’t the way to go.

The Economy of Conflict means that people who profit from holding stocks in the arms industry, whether they realise or not, are disincentivised to want peaceful solutions. At Pathfinder we often say, ‘money isn’t good or bad, it’s how you make it and how you use it, that matters.’

At times, navigating what a company is generating all their revenue from can be difficult for the investment team. Companies aren’t always transparent about their revenue streams and there are often grey areas. For example, there could be questions around whether a company is intentionally making a shift in their services for military benefit, or how close a piece of tech (e.g. facial recognition) is related to arms manufacture. As an active manager (as opposed to a passive index fund) we work to navigate the grey areas, watching our data sources, checking company disclosure statements and adjusting our investments accordingly.

Find an alternative.

Investing shapes the world we live in; together we can shape a better one.

“Whether your investments hold weapons or not is ultimately a personal choice. It’s a balance between protecting a nation’s freedom, promoting a stable world, maintaining strong civil institutions, and protecting civilian lives. It’s also about feeling good with how you’re investing”. John Berry, Pathfinder CEO and Wayfinder

“We invest looking through an opportunity rather than a constraint lens. We spend a lot of time looking for growth opportunities that exist that hopefully make the world a better place, acknowledging not all investments we make can do both. We focus on high value technologies or new product categories that are likely to become highly profitable and align with our mandate”. Mike Kenealy, Portfolio Manager

Pathfinder was recently placed in the top 20% of responsible investors and named as a Responsible Investment Leader by the Responsible Investment Association Australasia. This demonstrates leading practice in our commitment to responsible investing; our explicit consideration of environmental, social and governance factors in investment decision making; our strong and collaborative stewardship; and our transparency in reporting activity, including the societal and environmental outcomes being achieved.

For more detail on how we invest, listen to our Chief Investment Officer Paul Brownsey talk about our “Investing in an imperfect world” on The Everyday Investor podcast.

If you’re not a Pathfinder KiwiSaver member you can check to see if your KiwiSaver is invested in weapons on your behalf by using Mindful Money’s Compare Funds Tool. https://mindfulmoney.nz/managed/checker/

--------

[1] To read more about exactly where we draw the line when it comes to weapons, you can read our Ethical Investing Policy.

by Lily Richards

Chief Marketing and Client Officer

With over 10 years of marketing experience in a variety of industries (such as publishing, creative arts and technology), Lily brings an outsider's eye to the financial industries. Overseeing PR, advertising, communications and brand, Lily is passionate about helping Kiwis harness the power of ethical investing to grow wealth and well-being.