Insights

Growing wealth with compounding returns

When your KiwiSaver (or any investment) makes a return, those returns start ‘also’ making returns. This is known as compound interest or more specifically compounding returns.

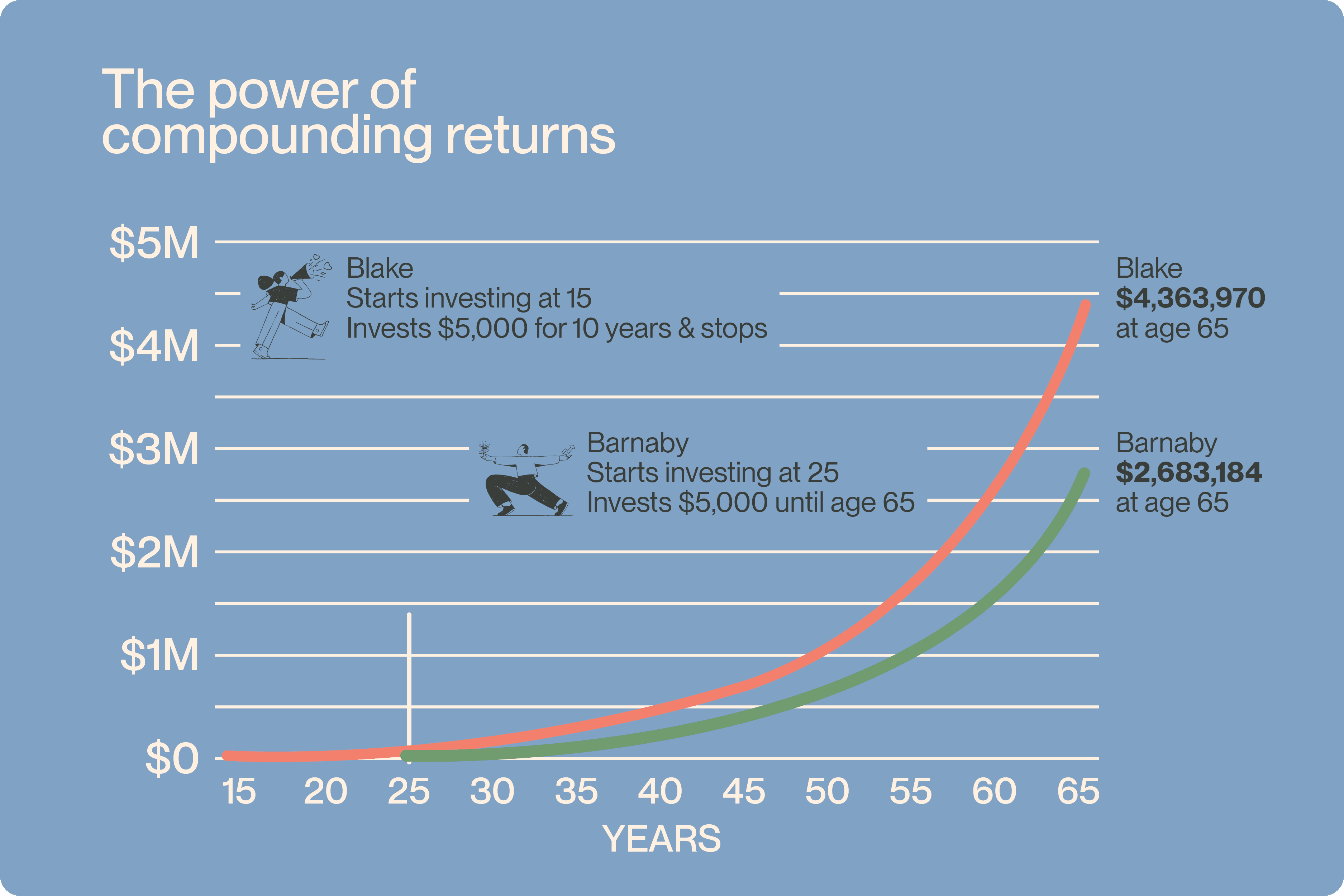

To make the most of compounding returns, the sooner you start, the better off you will be. Let’s compare two friends Blake and Barnaby.

Blake, aged 15 starts doing holiday work on the family farm. She manages to save $5,000 each year for ten years into a managed fund (like Pathfinders). Along the way she receives an average return of 10% per year including all dividends that are reinvested. And she stops contributing annually after ten years but holds the investment until she is 65.

Barnaby waits until he gets a full-time job before he starts investing at age 25. Like Blake, he puts in $5,000 a year, but unlike Blake, he doesn’t stop. He keeps on investing $5000 every year until he’s 65 years old (also reinvesting his dividends).

All up, Blake put in $50,000. Barnaby puts in $200,000.

Question: Who do you think has more money at age 65?

Answer: Even though Blake put a quarter of the money, her investment is worth 50 per cent more! (Blake’s investment is worth $4,363,970, Barnaby’s is $2,683,184. That’s the power of long-term investing. That’s the power of time.

Long-term investing great way to grow your finances, even if you don’t have a lot to begin with and especially if you start early. Compounding returns thankfully take some of the pain out of saving for the future. It’s easy to increase contributions to your KiwiSaver through your employer or by making a one off or regular deposit (FAQs | Pathfinder Asset Management), or if you think you may need your money sooner than age 65 you can look at investing outside KiwiSaver in an ethically managed fund.

Further reading, listening and activites

To find out more about saving for your future read our blog on saving for your 20-year holiday.

To find out more about helping your kids save for their future Sharesies has some great resources for teaching kids about money. Here are some of our favourites.

Getting started: Investing and saving for kids

The Happy Saver: How to talk to kids about money

Primary school age activity sheets: Bank of kid

Or if you are into podcasts listen to the Shared Lunch Kids Investor series that is aimed at helping kids and teens with money, investing, and developing healthy habits.

Kids & Money with Jamie Beaton from Crimson Education

Kids & Money with ZM Drive host Clint Roberts

Kids & Money with Nigel Latta